lottery calculator michigan|Best Lottery Tax Calculator: Lottery Winnings After Tax by State : Pilipinas Michigan Lottery Taxes. Any winnings accrued through the Michigan Lottery are subject to federal, state and local taxes. The Michigan Lottery does not withhold . Also, you might want to check our collection of Pokemon emerald cheats to find out which other cheat codes are useful for your game. Whether you’re a seasoned player or new to the world of Pokemon Emerald, these cheats are invaluable tools for getting the most out of your game. Also read: Top 6 Safest Cheats to Use in Pokemon .

PH0 · Powerball Calculator: Payout, Tax & Annuity Explained

PH1 · Official Michigan Lottery Homepage

PH2 · Michigan Lottery Tax Calculator

PH3 · Michigan Gambling Taxes: Calculator, Rates and Forms

PH4 · Michigan Gambling Tax Guide: Tax Calculator & Guide 2024

PH5 · Lotto Tax Calculator

PH6 · Lottery Tax Calculator: How Your Winnings Are Taxed

PH7 · Lottery Tax Calculator

PH8 · Best Lottery Tax Calculator: Lottery Winnings After Tax by State

Jogos online na CrazyGames. CrazyGames é uma plataforma de jogo de navegador que apresenta os melhores jogos online gratuitos. Todos os nossos jogos são executados no navegador e podem ser jogados instantaneamente, sem downloads ou instalações.

lottery calculator michigan*******Use the Michigan Lottery tax calculator to find out how much you'll receive if you win a prize. Just enter your prize amount to find out more.Gambling/lottery winnings are subject to Michigan individual income tax to the extent that they are included in your adjusted gross income. This means the ‘Net Payout’ you see .lottery calculator michigan Best lottery tax calculator to calculate your net winnings after federal and state taxes are deducted. Know how much you'll take home before claiming your prize.The state tax on lottery winnings is 4.25% in Michigan, which you'll have to pay on top of the federal tax of 25%. There might be additional taxes to pay, the exact amount of . Michigan Lottery Taxes. Any winnings accrued through the Michigan Lottery are subject to federal, state and local taxes. The Michigan Lottery does not withhold .Lotto Tax Calculator. Our intuitive and user-friendly calculator is designed to provide you with accurate estimates of the taxes you may owe on your lottery prize. Just enter in .Jump to the Lottery Tax Calculator. At a glance: Lottery winnings are considered taxable income for both federal and state taxes. Federal tax rates vary based on your tax bracket, with rates up to 37%. Winning the .Michigan Lottery's official online homepage with 24 hour instant games online. View current jackpots & winning numbers. Register for exclusive rewards and bonuses.

Guide to Michigan gambling tax law. Learn how gambling winnings and losses may affect your tax returns, and more about how to file your taxes and Form W-2G.

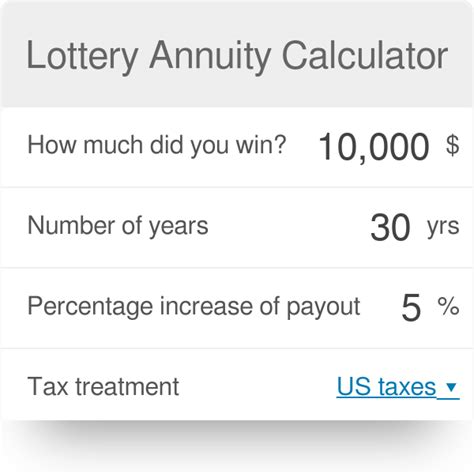

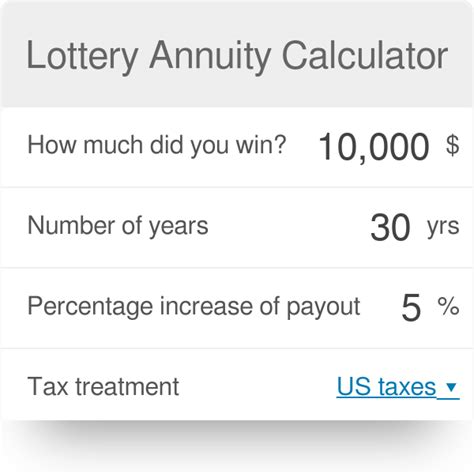

Best Lottery Tax Calculator: Lottery Winnings After Tax by StateA lottery payout calculator can also calculate how much federal tax and state tax apply on your lottery winnings using current tax laws in each state. You can calculate your lottery lump sum take home money, annuity payout and total tax amount that you need to pay after winning from Megamillions, Powerball, Lotto, etc by using our online . Annuity-based lottery payouts work the same way as common immediate annuities. More specifically, lottery annuity payments are a form of structured settlement where the scheduled payments are 100 percent guaranteed by the lottery commission. In general, lottery annuity payments consist of an initial payment and a number of .

The lottery calculator below will help you estimate the amount of tax that may be withheld on lump-sum lottery winnings. Enter the amount won to estimate potential federal withholding on your . Michigan Gambling Winnings Tax Calculator. Your tax rate is dependent on a few things, such as your tax bracket and annual income. . This includes winnings from any real money online casino in Michigan, online sports betting, poker tournaments, and the Michigan Lottery. Sportsbooks or casinos can withdraw federal and state tax before .

The initial state withholding taxes are based on published guidance from each state lottery and the final state tax rates are from state government publications. . Michigan: 4.25% state tax - $888,250 - $13,136,750: Your average net per year: $12,320,562: . We perform a marginal tax calculation, which does provide a good representation of .LottoLibrary.com's lottery tax calculator tool is free to use. There are no hidden fees or charges. Please note: We might show you 3 rd party ads or affiliate links. You can read more about this in our T&C document. Disclaimer This tool is intended for informational, educational, and entertainment purposes only. Lottery taxes are complicated .Federal Taxes on Lottery Winnings. Lottery winnings are treated as income in the United States, so your final tax bill depends on how much money you make in total in a year, not just the amount you win in the lottery. The following table shows the federal tax obligations for a Powerball winner filing as a single taxpayer. To use the calculator, select your filing status and state. The calculator will display the taxes owed and the net jackpot (what you take home after taxes). . (7.15%) Maryland (8.95%) Massachusetts (5%) Michigan (4.25%) Minnesota (7.25%) Mississippi (3%) . The lottery automatically withholds 24% of the jackpot payment for federal taxes . Easily calculate taxes on lottery winnings by each state plus the payouts for both cash & annuity options using our lottery calculators. You can also calculate your odds of winning Mega Millions and Powerball! . Michigan Lottery. Lucky For Life MI; Poker Lotto MI; Fantasy 5 MI; Daily 4 MI; Daily 3 MI; Club Keno MI; Classic Lotto 47 .

However, in the event of any discrepancies, the official records maintained by the Michigan Lottery shall prevail. Must be at least 18 years or older and physically located in Michigan to make purchases and use some other features. Failure to follow these requirements may violate state and federal law and void any prize won.The Lottery Tax Calculator takes into account the latest tax laws and regulations, ensuring you get the most accurate and up-to-date results. ESTIMATED JACKPOT $267,000,000 CASH VALUE $247,500,000 Next Drawing Friday, Sep 29th. ESTIMATED JACKPOT $960,000,000 CASH VALUE

lottery calculator michigan Best Lottery Tax Calculator: Lottery Winnings After Tax by State Example calculation of annuity lottery taxes. Because lottery jackpots are typically advertised as the annuity amount, you don’t need to estimate the gross payout. You’ll use the exact reward .

Lottery winnings tax calculator estimates the taxes on lottery winnings on the amount of the winnings, state of purchase, and lump sum or annuity payment type. . Michigan : 4.25 % : Minnesota : 7.25 % : Mississippi : 0 % : Missouri : 4 % : Montana : 6.9 % : Nebraska : 5 % : Nevada : 0 % : New Hampshire : 0 % : New Jersey : 8 % : New .

LottoLibrary.com's lottery tax calculator tool is free to use. There are no hidden fees or charges. Please note: We might show you 3 rd party ads or affiliate links. You can read more about this in our T&C document. Disclaimer This tool is intended for informational, educational, and entertainment purposes only. Lottery taxes are complicated .

You can use this lottery number generator to generate your lottery numbers for Mega Millions, Powerball, Lotto Max, UK National Lottery, and many other lotteries. Please follow this step-by-step instruction below. Choose your lottery region; Select your favorite lottery from the drop-down list or just fill in the other fields below

If you are lucky enough to win the lottery, you need to make an important decision on how to collect your prize.In general, there are two ways the Powerball pays out: through a lottery annuity or as a lump sum.. In general, if you would like to receive all of your money as early as possible, the lump-sum Powerball payout is the best option for . Calculate the taxes you need to pay if you win the current Powerball jackpot and, more importantly, how much money you will take home! . (8.95%) Massachusetts (5%) Michigan (4.25%) Minnesota (7.25%) Mississippi (3%) . The lottery automatically withholds 24% of the jackpot payment for federal taxes. When you file your next return .However, in the event of any discrepancies, the official records maintained by the Michigan Lottery shall prevail. Must be at least 18 years or older and physically located in Michigan to make purchases and use some other features. Failure to follow these requirements may violate state and federal law and void any prize won.

We hope this catalogue of cheat codes for Pokémon Emerald has been beneficial for you. Remember, the application of cheat codes should be done responsibly and they're here to increase your gaming pleasure. Make sure to always backup your save files before using cheat codes! 15 Feb 2024.Online Casinos mit Amazon Pay. Obwohl die Verbreitung von Amazon Pay in Online-Casinos noch begrenzt ist, gibt es einige renommierte Casinos, die diese Zahlungsmethode unterstützen. Dazu gehören bekannte Namen wie das 888 Casino, das Party Casino und das William Hill Casino.

lottery calculator michigan|Best Lottery Tax Calculator: Lottery Winnings After Tax by State